Comparing Different Retirement Plans 401k vs IRA

Understand the differences between 401k and IRA to choose the best retirement plan for your financial future.

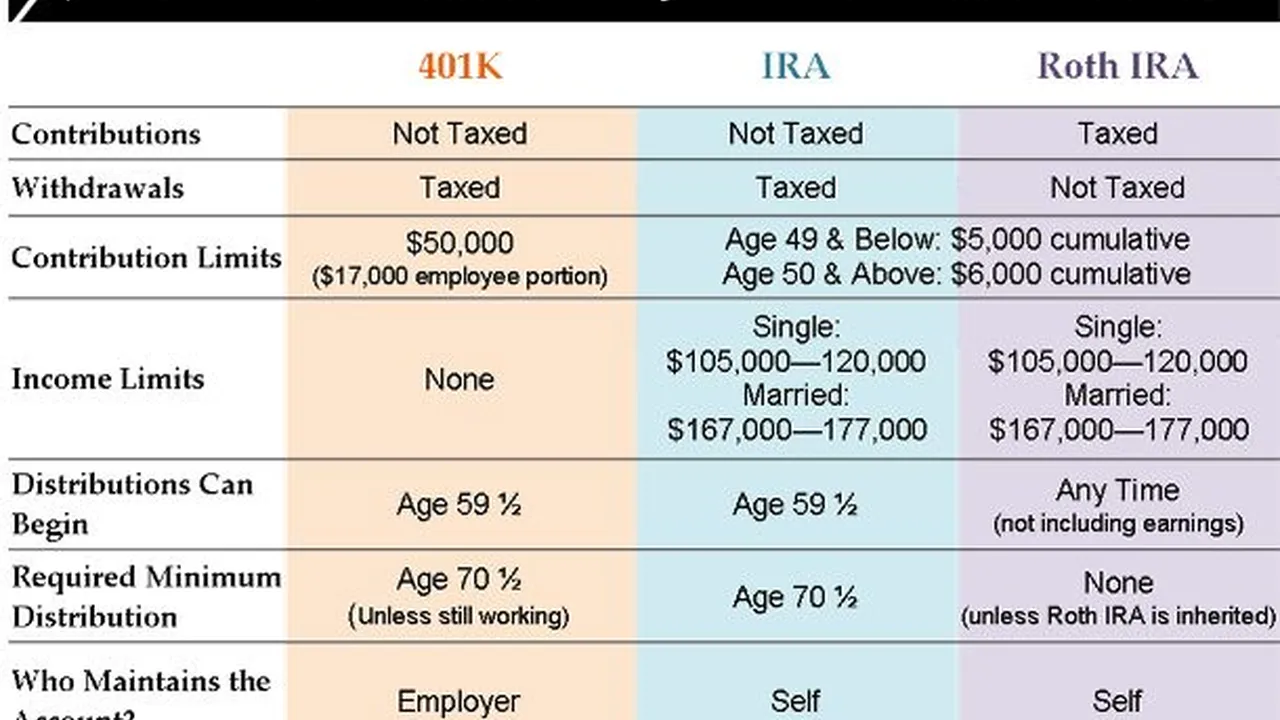

Understanding the differences between 401(k) and IRA is crucial for securing your financial future. These two popular retirement savings vehicles offer distinct advantages and disadvantages, making the choice highly dependent on your individual circumstances, employment situation, and financial goals. This comprehensive guide will break down everything you need to know about 401(k)s and IRAs, helping you make an informed decision for your retirement planning.

Understanding Retirement Plans 401k vs IRA

What is a 401(k) Exploring Employer Sponsored Retirement Plans

A 401(k) is an employer-sponsored retirement savings plan that allows employees to contribute a portion of their pre-tax salary to an investment account. These contributions grow tax-deferred, meaning you don't pay taxes on the earnings until you withdraw the money in retirement. Many employers offer a matching contribution, which is essentially free money that significantly boosts your retirement savings. This employer match is one of the most compelling reasons to participate in a 401(k) if available.

Types of 401(k) Plans Traditional vs Roth 401(k)

There are two main types of 401(k) plans: Traditional 401(k) and Roth 401(k).

- Traditional 401(k): Contributions are made with pre-tax dollars, reducing your current taxable income. Your investments grow tax-deferred, and withdrawals in retirement are taxed as ordinary income. This is often beneficial if you expect to be in a lower tax bracket in retirement than you are now.

- Roth 401(k): Contributions are made with after-tax dollars, meaning your contributions do not reduce your current taxable income. However, qualified withdrawals in retirement are completely tax-free. This is advantageous if you expect to be in a higher tax bracket in retirement or if you want to avoid future tax liabilities on your retirement income.

Contribution Limits and Catch Up Contributions for 401(k)s

The IRS sets annual contribution limits for 401(k) plans. For 2024, the maximum employee contribution is $23,000. If you're age 50 or older, you can make an additional catch-up contribution of $7,500, bringing your total to $30,500. These limits are subject to change annually, so it's always a good idea to check the latest IRS guidelines.

Investment Options and Fees in 401(k) Plans

Investment options within a 401(k) are typically limited to a selection of mutual funds, exchange-traded funds (ETFs), and sometimes target-date funds chosen by your employer. While this can simplify investment decisions, it also means you have less control over your investment choices compared to an IRA. It's crucial to review the fees associated with your 401(k) plan, including administrative fees, investment management fees, and expense ratios of the funds. High fees can significantly erode your returns over time.

What is an IRA Understanding Individual Retirement Accounts

An Individual Retirement Account (IRA) is a personal retirement savings plan that you can open and manage yourself, independent of your employer. IRAs offer a broader range of investment options and more control over your portfolio. They are an excellent option for those whose employers don't offer a 401(k), or for those who want to supplement their employer-sponsored plan.

Types of IRA Plans Traditional vs Roth IRA

Similar to 401(k)s, IRAs also come in Traditional and Roth versions:

- Traditional IRA: Contributions may be tax-deductible, depending on your income and whether you're covered by an employer-sponsored retirement plan. Earnings grow tax-deferred, and withdrawals in retirement are taxed.

- Roth IRA: Contributions are made with after-tax dollars, so they are not tax-deductible. However, qualified withdrawals in retirement are completely tax-free. Roth IRAs are particularly attractive for younger individuals who expect their income and tax bracket to be higher in the future.

Contribution Limits and Income Phase Outs for IRAs

The annual contribution limit for IRAs in 2024 is $7,000. If you're age 50 or older, you can contribute an additional $1,000 as a catch-up contribution, bringing your total to $8,000. It's important to note that there are income limitations for contributing to a Roth IRA and for deducting Traditional IRA contributions if you're covered by a workplace retirement plan. These income phase-outs can affect your eligibility for certain tax benefits.

Investment Flexibility and Control with IRAs

One of the biggest advantages of an IRA is the vast array of investment options available. You can invest in stocks, bonds, mutual funds, ETFs, real estate, and more. This flexibility allows you to tailor your investment strategy to your specific risk tolerance and financial goals. You also have complete control over your investment decisions, which can be empowering for experienced investors but might require more research for beginners.

Key Differences and Similarities 401(k) vs IRA Comparison

While both 401(k)s and IRAs are powerful tools for retirement savings, they have distinct characteristics:

Employer Match and Contribution Limits

The most significant difference is the employer match. Only 401(k)s offer this benefit, which can be a substantial boost to your savings. 401(k)s also have much higher contribution limits than IRAs, allowing you to save more each year.

Tax Treatment and Withdrawal Rules

Both offer tax advantages, but the timing of those advantages differs. Traditional accounts offer an upfront tax deduction, while Roth accounts offer tax-free withdrawals in retirement. Withdrawal rules also vary, with 401(k)s often having more stringent rules regarding early withdrawals and rollovers.

Investment Choices and Control

IRAs offer far greater investment flexibility and control. You can choose from a wider range of assets and manage your portfolio actively. 401(k)s, on the other hand, have a more limited selection of pre-selected funds.

Accessibility and Portability of Funds

401(k)s are tied to your employer, meaning you'll need to decide what to do with your funds if you leave your job (e.g., roll over to an IRA or new 401(k)). IRAs are personal accounts, offering greater portability and accessibility regardless of your employment status.

Choosing the Best Retirement Plan for You Making Informed Financial Decisions

The best retirement plan for you depends on several factors. Here's a breakdown to help you decide:

When a 401(k) is Your Best Option Maximizing Employer Benefits

If your employer offers a 401(k) with a matching contribution, contributing at least enough to get the full match should be your top priority. It's essentially free money that you shouldn't pass up. A 401(k) is also a good choice if you want to contribute more than the IRA limits allow or if you prefer a simpler, more hands-off investment approach with pre-selected funds.

When an IRA is Your Best Option Flexibility and Control

An IRA is an excellent choice if your employer doesn't offer a 401(k), or if you've already maxed out your 401(k) contributions. It's also ideal if you desire greater control over your investment choices and prefer a wider range of investment options. Roth IRAs are particularly beneficial for young professionals who anticipate being in a higher tax bracket in the future.

Combining 401(k) and IRA for Optimal Retirement Savings

For many people, the optimal strategy involves utilizing both a 401(k) and an IRA. A common approach is to first contribute enough to your 401(k) to get the full employer match, then max out your IRA contributions (especially a Roth IRA if eligible), and finally, if you still have funds available, contribute more to your 401(k) up to the annual limit. This strategy allows you to take advantage of both employer matching and the flexibility of an IRA.

Specific Product Recommendations and Scenarios for Retirement Planning

Let's dive into some specific product recommendations and scenarios to illustrate how these plans work in practice.

Scenario 1: Young Professional Starting Out

Situation: Sarah, 25, just started her first full-time job. Her company offers a 401(k) with a 3% match. She's in a relatively low tax bracket now but expects her income to grow significantly.

Recommendation:

- 401(k) (Roth option if available): Sarah should contribute at least 3% to her 401(k) to get the full employer match. If her company offers a Roth 401(k), she should strongly consider contributing to that, as her tax-free withdrawals in retirement will be very valuable when she's likely in a higher tax bracket.

- Roth IRA: After securing the 401(k) match, Sarah should open and contribute the maximum to a Roth IRA. This gives her additional tax-free growth and withdrawals in retirement.

Example Products/Platforms:

- 401(k): Your employer's chosen provider (e.g., Fidelity, Vanguard, Empower). You'll typically have a selection of target-date funds, index funds (like Vanguard S&P 500 Index Fund), and actively managed funds.

- Roth IRA: Open an account with a low-cost brokerage like Fidelity, Vanguard, or Charles Schwab.

- Fidelity Go (Robo-Advisor): For beginners, Fidelity Go offers automated investing with low fees (0.35% AUM for balances over $25,000, no advisory fee for balances under $25,000). It builds a diversified portfolio based on your risk tolerance.

- Vanguard Target Retirement Funds: These are excellent for hands-off investing. For example, the Vanguard Target Retirement 2065 Fund (VTTSX) automatically adjusts its asset allocation as you get closer to retirement. Expense ratio around 0.08-0.15%.

- Schwab Intelligent Portfolios (Robo-Advisor): Similar to Fidelity Go, Schwab offers commission-free automated investing.

Scenario 2: Mid-Career Professional with High Income

Situation: David, 40, earns a high income and is already maxing out his Traditional 401(k) contributions. He's looking for additional ways to save for retirement.

Recommendation:

- Backdoor Roth IRA: Since David's income likely exceeds the Roth IRA direct contribution limits, he can utilize the 'backdoor Roth IRA' strategy. This involves contributing non-deductible funds to a Traditional IRA and then immediately converting them to a Roth IRA. This allows high-income earners to still benefit from tax-free growth and withdrawals.

- Taxable Brokerage Account: After maxing out all tax-advantaged accounts, David should consider investing in a regular taxable brokerage account for additional long-term growth.

Example Products/Platforms:

- Traditional IRA (for Backdoor Roth): Any major brokerage like Fidelity, Vanguard, or Charles Schwab.

- Taxable Brokerage Account:

- M1 Finance: Offers automated investing with custom 'pies' of ETFs and individual stocks. No management fees for basic accounts.

- Interactive Brokers: Known for its wide range of investment products and low commissions, suitable for more active investors.

- Schwab Total Stock Market Index Fund (SWTSX): A low-cost way to get broad market exposure in a taxable account. Expense ratio 0.03%.

Scenario 3: Small Business Owner or Freelancer

Situation: Emily, 35, is a successful freelance graphic designer. She doesn't have an employer-sponsored 401(k) but wants to save aggressively for retirement.

Recommendation:

- Solo 401(k): This is an excellent option for self-employed individuals or small business owners with no full-time employees (other than a spouse). It allows for very high contribution limits, acting as both an employee and employer.

- SEP IRA: Another strong option for self-employed individuals, offering high contribution limits based on a percentage of net earnings. Simpler to set up than a Solo 401(k) but less flexible in terms of contribution types.

- Roth IRA: Emily should also contribute to a Roth IRA if her income allows, for the tax-free growth.

Example Products/Platforms:

- Solo 401(k): Available through providers like Fidelity, Vanguard, or Charles Schwab. These typically offer a wide range of investment options similar to a regular brokerage account.

- SEP IRA: Also available at major brokerages.

- Vanguard Small Business Retirement Plans: Offers both Solo 401(k) and SEP IRA options with low-cost index funds and ETFs.

- Fidelity Self-Employed 401(k): Provides a robust platform for managing your Solo 401(k) with diverse investment choices.

Important Considerations for Your Retirement Journey

Understanding Vesting Schedules in 401(k) Plans

When your employer contributes to your 401(k), those contributions often come with a vesting schedule. This means you only fully own the employer's contributions after a certain period of employment. If you leave before you're fully vested, you might forfeit some or all of the employer's contributions. Always check your plan's vesting schedule.

The Power of Compounding and Early Contributions

The earlier you start saving, the more time your money has to grow through the power of compounding. Even small contributions made consistently over a long period can accumulate into a substantial sum. Don't underestimate the impact of starting early.

Diversification and Asset Allocation Strategies

Regardless of whether you choose a 401(k) or an IRA, or both, diversification is key. Don't put all your eggs in one basket. Spread your investments across different asset classes (stocks, bonds, real estate) and industries to mitigate risk. Your asset allocation should align with your risk tolerance and time horizon. Younger investors can typically afford to take on more risk, while those closer to retirement should consider a more conservative approach.

Rollover Options When Changing Jobs

If you leave a job, you have several options for your 401(k):

- Leave it with your old employer: This might be an option, but it can make managing your retirement accounts more complex.

- Roll it over to your new employer's 401(k): If your new employer offers a 401(k) and allows rollovers, this can consolidate your accounts.

- Roll it over to an IRA: This is a popular option as it gives you more control over your investments and typically a wider range of choices.

- Cash it out: This is generally not recommended as it can trigger significant taxes and penalties, especially if you're under 59½.

Seeking Professional Financial Advice

Retirement planning can be complex, and your individual situation is unique. Consider consulting with a qualified financial advisor. They can help you assess your financial goals, understand your risk tolerance, navigate tax implications, and create a personalized retirement plan that maximizes your savings and minimizes your tax burden. A good advisor can be invaluable in helping you make the best choices for your financial future.

Ultimately, both 401(k)s and IRAs are powerful tools for building a secure retirement. By understanding their differences, leveraging their strengths, and making consistent contributions, you can set yourself up for a comfortable and financially independent future. Start saving today, and watch your wealth grow.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)